Q2 2022 White Oak Client Letter

The first quarter of 2022 contained volatile news headlines which negatively impact capital markets. The macro-economic environment is facing numerous negative factors including:

· Growing inflationary pressures

· Geopolitical risks remain high

· Higher interest rates causing concerns about excess leverage

· Hawkish Federal Reserve

· China dealing with new wave of COVID-19 which threatens supply chain issues

· Temporarily inverted yield curve

However, in the face of substantial negative news, the S&P 500 total return was down only 4.69% year to date, as of March 31st. This is impressive since it was down 12.17% at its lowest point in Q1. We believe the key to the market’s performance in 2022 hinges on whether the US enters a recession. We believe the US will avoid a recession for reasons we expand on below. We remain optimistic on economic growth and return expectations for US capital markets in general. Markets bottomed on February 24th, the day of the Russian invasion of Ukraine and have steadily recovered since in the face of continuing (increasing) negative news.

The potential spread of war beyond the borders of Ukraine is our largest concern and did not exist when we wrote our Q1 client letter. The prospect of a larger global conflict renders much of our research and forecasting moot as such an event would impact markets to an extent we have not experienced to date. We have and continue to synthesize those impacts in our investment research and decision making.

The already elevated price of oil has been further exacerbated by the war, and in recent weeks the prices of agricultural and metals commodities have also been impacted. Ukraine and Russia produce 11.5% and 16.8% of the world’s wheat, respectively and Ukraine supplies 17% of the worlds corn. In March, Russia announced a grain export ban and began preventing ships from leaving ports in the Black Sea, many of them carrying grains.

Grains are an essential input into much of the food produced globally and as its price increases, so does the cost of producing a variety of other foods.

Many are concerned that if the cost of oil and gasoline remains high, consumers will reduce spending, leading to lower economic activity and a possible recession. Oil has recently been over $100/barrel and the last time this occurred was in 2008 and in the 1980s. Our research indicates that the actual economic impact of higher gas prices on consumers is not as significant today. Two factors have changed

· Gasoline per capita use today is 414 gallons, 11% lower than 2008 and 20% lower than 1980.

· Per capita income today is $63,500 vs $48,000 in 2008 and $10,700 in 1980, therefore

· Gasoline as a percentage of consumer wallet share is 3% today, 4.5% in 2008 and 6.5% in 1980.

We agree that consumers will change their spending habits but argue that it will take more than higher gas prices for them to do so. Rather, consumers are facing higher prices for many basic staples (food and grocery products, household products) in addition to rising gas prices. We believe an improvement in supply chain issues will help alleviate elevated costs for staples in the short/intermediate term. Oil prices will likely remain elevated for longer due to structural supply constraints preventing producers from meeting growing demand.

Inflation:

At times, like the present, as has been the case historically following a war, a financial panic, a pandemic or a depression, inflation tends to run above average. Just like it was after World War II, the Vietnam War, the Financial Crisis in 2008-2009, and now the COVID Pandemic. Inflation reduces the burden of our government’s indebtedness incurred to fight wars and plagues and to stabilize our economy. Our government devalues its currency through inflation so debt will be a smaller part of our economy. This allows America to pay interest on borrowings with less valuable dollars. Inflation is also present in ordinary times.

Inflation in the U.S. on average doubles the price of what we purchase about every 14-15 years. This means prices on average increase over the long term about 4% to 5% per year. Stock prices have grown significantly faster than inflation. The U.S. economy and U.S. stock markets grow over the long term about 7% to 8% per year. Historically equities have been the best tool to protect assets against the effects of inflation. That is why, even though we have experienced a volatile first quarter, we remain committed to our investment strategies for long-term growth.

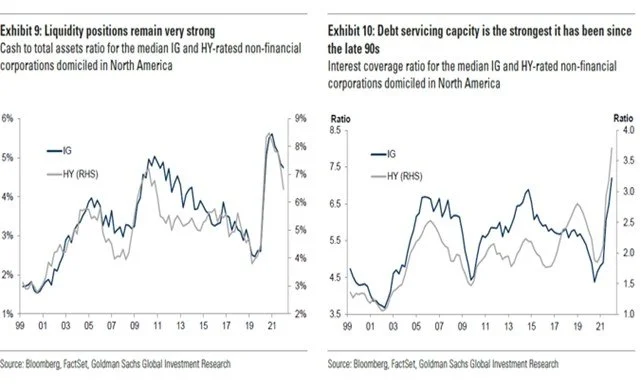

Supporting our outlook, consumers have strong balance sheets, elevated levels of liquidity and a historically strong labor market sustaining their spending capabilities.Businesses also enjoy strong liquidity positions and healthy balance sheets.Recessions are typically preceded by a business cycle contraction, meaning corporate financial stability plays a key role. While their profit margins will be challenged, corporate liquidity is strong, this mitigates a larger downturn risk.As the charts below show, corporate cash to assets is near the top decile, debt servicing capacity is strongest in 23 years and net debt/earning (EBIDTA) is manageable.

In our last letter, we forecast that the Federal Reserve would increase the rate three times in 2022 by 25 basis points each. Over the past quarter, Fed Chairman Jay Powell and other Fed officials have said they may increase the Fed Funds rate four to six times in 2022 and will reduce its balance sheet by $95 billion/month beginning in March. Therefore, we believe our initial projection of rate increases was too low but we are not yet convinced the Fed will follow through on that many increases in 2022. The Fed has a history of being deliberate and we believe there is a reasonable chance that broad-based inflation measures will begin to recede in the second half of the year and possibly slow the Fed's pace of rate increases.

There are numerous recent signs that indicate we have achieved the lows for the year and that in spite of legitimate concerns, markets remain resilient and positioned to move higher this year.The decline in equity prices and increase in oil prices are hurting consumer sentiment.The February University of Michigan Consumer Confidence Survey was a dismal 59.7, which has only been registered two times in the last 40 years; in the 1980’s and during the 2008 financial crisis. At the extremes, consumer confidence is a contrarian indicator.Below are the deciles of consumer confidence readings and the corresponding forward returns of the S&P 500.The February reading was in the lowest decile (pink shaded line), S&P 500 forward returns average 15% one year after readings in the lowest decile.While others are turning bearish and consumer confidence is at its lowest reading in years, history shows that markets tend to be significantly higher following readings in the bottom decile.

Our Outlook:

As the information and charts provided above indicate, we retain our “optimistic” outlook for economic growth and capital markets. We continue to monitor and digest how the Russian invasion of Ukraine may impact our outlook. To be clear, our optimism has been somewhat more restrained due to the Ukrainian war. The war notwithstanding, we believe that a strong economy, financially stronger consumers and corporations with clean balance sheets are not a recipe for a near-term recession.

We highlighted data that supports our optimistic outlook and we have also sought to identify areas of potential concern or asset bubbles, which often lead to recessionary environments. Consumers are not exhibiting signs of excess (like what preceded the 2008 financial crisis) which tend to occur near peak economic growth. Consumers also possess cleaner balance sheets, with their largest debt obligations at historically low fixed interest rates. Corporate balance sheets largely reflect these same positive narratives. In our view, the challenge to consumers will be managing intermediate term elevated costs and for corporations, managing their ability to pass higher costs to their customers. We have witnessed signs of easing supply chain issues. Should those continue we believe their impact on costs will have a more rapid impact on easing inflation than the Fed increasing interest rates. Should that occur, we believe the Fed will not need to increase rates to the extent it has indicated.

Our 2022 year-end expectation for the S&P 500 is between 5,000 and 5,100. The S&P closed at 4530.41 on March 31st. A year-end close at 5,000 represents a 10% increase from current levels and a 5% increase from where we started 2022. As we detailed in the Q1 letter, White Oak strategies contain allocations to assets that tend to do well in rising price/rising interest rate environments. Additionally, we continue to hold a meaningful allocation to commodities in all strategies.

Rising interest rates have us continuing to seek alternatives to traditional bonds to preserve client capital. Our exposure to fixed income remains tactical and we do not anticipate this to change until we return to a more normalized interest rate environment (where interest rates are closer to the rate of inflation).

In our Q1 letter we recommended that clients who have elevated cash positions consider adding cash to their portfolio. Late January 2022 provided an attractive entry point for new capital. We continue to suggest that clients consider adding cash to their portfolio which enables us to tactically add to positions at attractive entry points. We also provided an overview on the following topics.

COVID cases to roll over in early 2022

COVID-19 cases have fallen to extraordinarily low levels as of early April. However, the Omicron BA.2 subvariant is now the predominate strain of the virus. Fortunately, in the US, that has not led to a meaningful increase in cases or hospitalizations.

Markets have overreacted to the Fed increasing interest rates

Q1 expectation was that the Fed would raise rates three times in 2022 at 25bps each. As discussed above, we likely underestimated that call and believe the Fed will increase rates more aggressively but less than what some Fed officials have indicated.

Markets recover from the year-to-date sell-off in Q1 2022

When we distributed our Q1 letter, the S&P had declined 9.2% and it ended the quarter down 4.95% making up approximately half of its earlier decline.

We expect markets to be volatile throughout the first half of the year and less volatile in the second half as markets gain more certainty around geopolitical concerns, corporate profitability, inflation, and Fed actions.

Corporate profitability strengthens

Fueled by a strong consumer, healthy balance sheets and an improving labor market, we expect moderate levels of corporate profitability growth.

Indeed, Q4 2021 earnings were strong. 79% of S&P 500 companies exceeded their earnings estimate by an average of 7%. And 76% of companies exceeded their revenue estimates by an average of 3%. Early Q1 earnings have been positive, largely exceeding expectations.

2022 will present challenges that did not exist in 2021. Those challenges headwinds will highlight weak companies and reward stronger, well-run companies.

Stock picking will be a crucial component of successful equity investing as companies face additional headwinds over the next 12-24 months. We favor using active managers as opposed to passive index funds to identify the strongest companies for investment.

We continue to evaluate data and ideas to protect and grow client capital as we believe volatility will be elevated near-term. We remain optimistic that economic growth will continue albeit at a reduced rate than what we experienced in 2021. Please do not hesitate to contact us with any questions or thoughts. Thank you for your trust.